The market is full

of untapped ideas.

What’s yours?

Sign up* For illustrative purposes only. Not a recommendation of any security or strategy.

Now, you can create an investable index with AI. As easy as investing in an ETF, but with infinite possibilities.

01

Start with a prompt

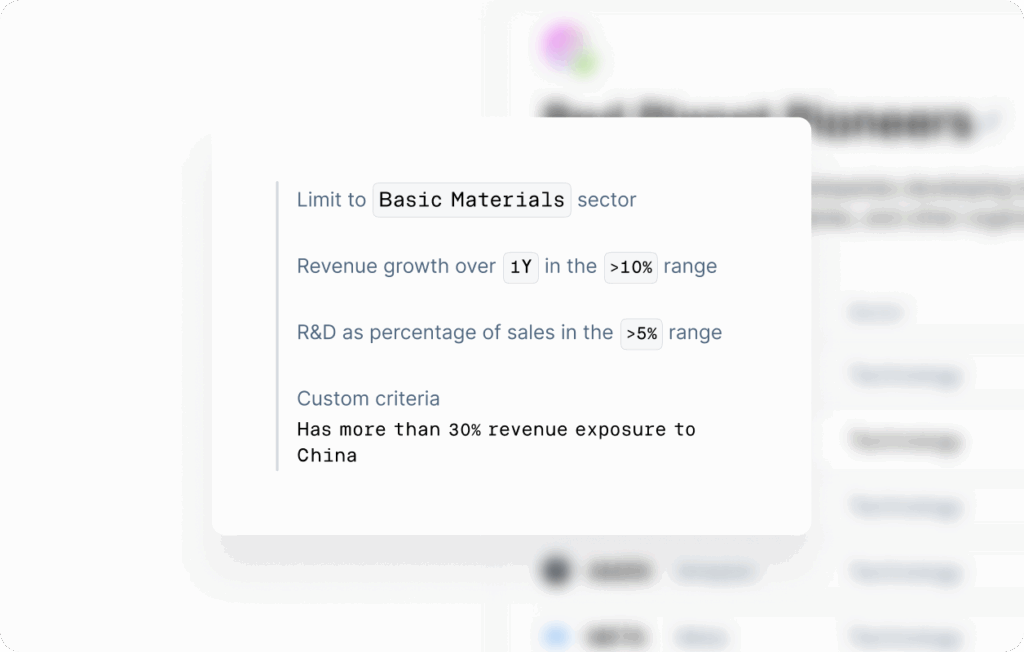

It all starts with your ideas—from themes like "Mars exploration" to specific criteria like "stocks with accelerating EPS but flat revenue growth."

02

Watch our AI go to work

Your prompt dispatches a swarm of evaluation agents to work in parallel, researching and screening thousands of stocks to build an index that matches your criteria.

03

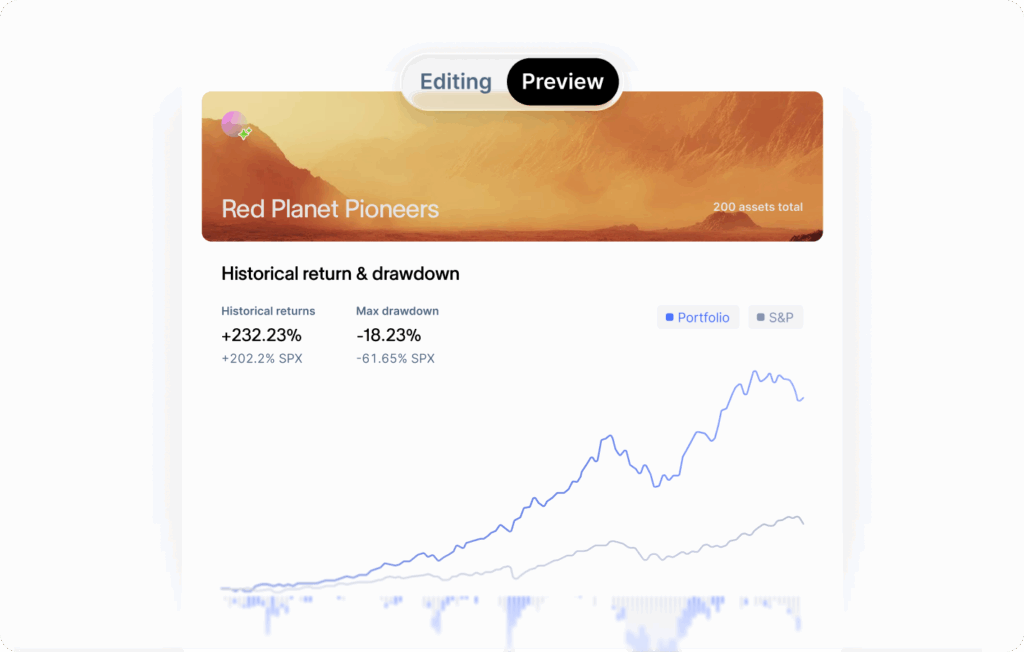

Backtest your ideas

We can show you how your index compares to the S&P 500®, with a unique asset score based on its historical returns, stability, and diversification.

04

Invest in your creations

Once you’ve finished refining your Generated Asset, you can invest in it directly and manage it alongside your other holdings, like your very own custom index.

Index ETFs were built for the ’90s. They're rigid by design, with no room for personalization. Generated Assets are the next leap in index investing.

| Generated Assets Generated Assets | Index ETFs Index ETFs |

|---|---|

| Built by you with AI Built by you with AI | Built by an ETF sponsor Built by an ETF sponsor |

| Based on your thesis Based on your thesis | Based on a predefined index Based on a predefined index |

| Endlessly customizable Endlessly customizable | No customization No customization |

| Unlimited opportunities Unlimited opportunities | ~2,100 US-Listed ETFs* ~2,100 US-Listed ETFs* |

*As of September 2024 - taken from Morningstar article titled “Will Active ETFs Outnumber Passive ETFs?

The conversation doesn't stop at creation. You can continue to refine your asset with follow-up prompts—adjust weightings, remove tickers, and more.

We can show you data—from historical returns across different time periods to maximum drawdowns—so you can gauge potential before you invest.

We’re expanding Generated Assets beyond just stocks. Soon, you’ll be able to build your own multi-asset portfolios with crypto, bonds, and more.

* For illustrative purposes only. Not a recommendation of any security or strategy.

Generated Assets are custom indices you create with AI using a natural-language prompt. Your idea dispatches a swarm of AI evaluation agents that research and screen stocks based on your criteria, then assemble an index you can analyze and invest in—similar to an ETF, but built around your own thesis.

Index ETFs are built by an ETF sponsor based on a predefined index and are not customizable. Generated Assets are built by you using AI. They are based on your unique thesis and are endlessly customizable, allowing you to create a one-of-a-kind index that you can invest in and manage.

Yes. Before you invest, you can backtest your ideas to see how your custom index’s hypothetical performance compares to benchmarks like the S&P 500®. We provide data on historical returns, stability, diversification, and maximum drawdowns to help you gauge potential.

Yes. Once you’ve finalized your index, you can invest in it directly through your Public account and manage it alongside your stocks, bonds, options, and more.

Generated Assets analyze a large universe of publicly available financial data—including fundamentals, historical performance, growth metrics, sector classifications, and more—to match your screening criteria. The system evaluates thousands of securities in parallel using a multi-agent research model.