Build long-term retirement savings with the potential for tax-free qualified withdrawals using a Roth IRA. Contribute after-tax income, allow your investments to grow tax-free, and withdraw contributions at any time.

Roth IRAs

Learn about Roth IRAs through this guide, and explore how you can use platforms like Public.com to manage your Roth IRA journey.

Table of contents

What is a Roth IRA?

A Roth IRA is a retirement account where you contribute money you’ve already paid taxes on. Provided certain requirements are met, you may withdraw both your contributions and any investment earnings tax-free in retirement.

To make qualified withdrawals of earnings without taxes or penalties, the Roth IRA must have been open at least five years, and you must be age 59½ or meet an approved exception, such as certain disabilities or a first-time home purchase.

Unlike Traditional IRAs, Roth IRAs do not require you to take minimum distributions during your lifetime, so your investments can remain in the account for as long as you like.

Compare Roth IRA vs.Traditional IRAs

Who can contribute to a Roth IRA in 2025?

You can contribute to a Roth IRA if:

- You have earned income (such as wages, salary or self-employment income).

- Your modified adjusted gross income (MAGI) is within IRS limits for your tax filing status.

- There is no age limit for making Roth IRA contributions as long as you meet the earned income and income limit requirements.

Let’s consider an example:

If you are 52 years old and have $80,000 in self-employment income, you may contribute up to $8,000 to a Roth IRA in 2025 ($7,000 base + $1,000 catch-up). If your income is above the phase-out range for your filing status, the amount you can contribute will be reduced or eliminated.

Why should you consider a Roth IRA?

There are several reasons why you might find a Roth IRA appealing as part of your long-term savings strategy:

- Tax-free qualified withdrawals: A Roth IRA offers the opportunity for tax-free withdrawals of both contributions and earnings in retirement, provided you meet certain conditions. This typically requires that the account has been open at least five years and you are 59 ½ or older, or you qualify under an IRS exception.

- No Required Minimum Distributions (RMDs): Unlike traditional IRAs, you are not required to start withdrawing money at age 73. This means your money can continue to grow tax-free for as long as you want.

- Flexibility with contributions: You can withdraw your original contributions at any time without penalty or taxes, providing a layer of financial flexibility that other retirement accounts may not offer.

- Potential estate planning benefits: The lack of RMDs during your lifetime means Roth IRA assets can be left to heirs, potentially allowing beneficiaries to receive tax-free distributions if the account has met the five-year rule.

- Potential tax diversification: Since Roth IRA contributions are made with after-tax dollars, they might provide a way to manage future tax exposure, particularly if you anticipate being in a higher tax bracket during retirement. Actual outcomes depend on future tax policies and individual circumstances.

As with any financial decision, it’s essential to consider your situation and review the latest IRS rules or consult with a qualified professional before making contributions.

Roth IRA rules and considerations

Before contributing to a Roth IRA in 2025, there are a few key rules you’ll want to keep in mind:

1. Contribution limits

You can contribute up to $7,000 if you’re under 50, or $8,000 if you’re 50 or older. These contribution limits apply to your combined contributions across all IRAs (Roth and Traditional) in a given tax year.

2. Income limits

Your eligibility to contribute depends on your modified adjusted gross income (MAGI) and your tax filing status. If your income falls within the IRS phase-out ranges, you may qualify for only a partial contribution; those above the upper threshold are ineligible for direct contributions.

- If you’re single, your ability to contribute starts phasing out at $150,000 and cuts off at $165,000.

- If you’re married filing jointly, the phase-out range is $236,000 to $246,000.

- If your income is too high for a direct contribution, you might look into a strategy like a Backdoor Roth IRA.

3. Withdrawal rules

You can withdraw your Roth IRA contributions at any time, for any reason, without taxes or penalties. To withdraw earnings tax-free, the account must be at least five years old, and you need to be 59 1⁄2 or older or meet certain exceptions (such as disability or qualified first-time home purchase).

4. No required minimum distributions (RMDs)

Unlike Traditional IRAs, there are no RMDs during your lifetime with a Roth IRA, so your money can remain invested as long as you choose.

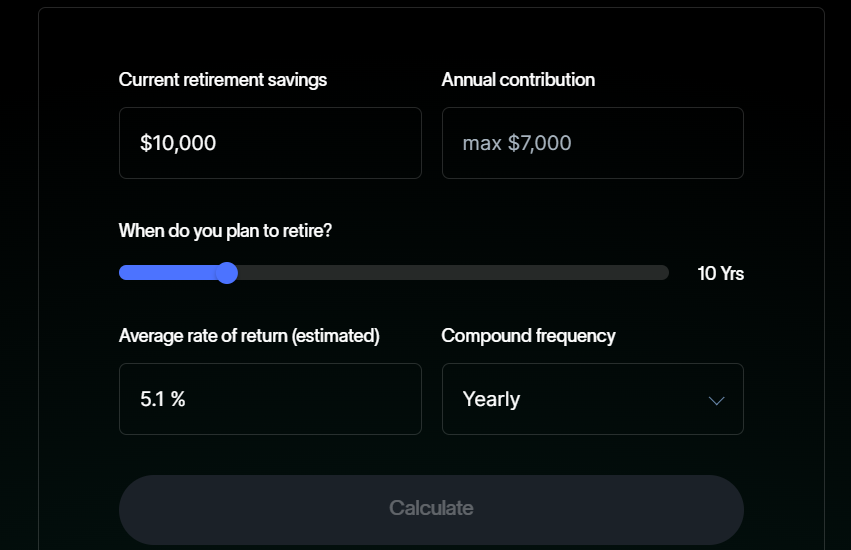

Use the Public.com calculator to project your potential Roth IRA balance

You can get an idea of how your Roth IRA savings might grow by using the IRA calculator available on Public’s platform. Just enter your current balance, how much you plan to contribute each year (up to $7,000 for 2025), your estimated return, and the number of years until retirement. The calculator shows how those contributions may add up over time, with the effects of compounding included.

You can explore different scenarios and adjust the inputs to see how changes in contributions or timelines might affect your long-term savings. Try it out directly on Public’s IRA calculator.

Where can you open a Roth IRA?

You can open a Roth IRA through most banks, brokerage firms, or investment platforms. Many investors use online brokerages to manage their Roth IRA alongside other accounts.

With Public, you can open a Roth IRA directly in the app and access a range of other investment options like stocks, bonds, high-yield cash accounts, ETFs, treasuries, crypto, and options, all in one place.

How to open a Roth IRA account on Public.com

Whether you’re opening a new Roth IRA or transferring an existing one, Public.com offers features to help you contribute, invest, and monitor your account.

Here’s how to get started:

- Open IRA: To open an IRA, visit Public.com or download the Public app on iOS or Android

- Sign up: Create an account in the app. Navigate to the “Build Your Portfolio” section or Account Settings, and select “Open IRA” to start the process.

- Fund your account: Link your bank for secure transfers, or roll over an existing IRA or 401(k). Public.com supports both direct contributions and rollovers.

- Set up contributions: Choose one-time or automatic recurring deposits to help stay on track with your retirement goals.

- Invest and manage: Access thousands of stocks, ETFs, and bonds, and use Public’s tools to build and monitor your portfolio.

- Track progress: Use the intuitive dashboard to monitor your investments and adjust as needed.

Conclusion

A Roth IRA is designed to offer tax-free withdrawals under certain conditions and doesn’t require distributions during your lifetime. It may be used to support long-term growth and provide flexibility in how you access retirement savings. Whether you’re early in your career or considering different retirement strategies, understanding how a Roth IRA works can help you evaluate your options..

If you’re considering opening a Roth IRA through a brokerage platform, sign up on Public.com to get started. Public.com allows you to:

- Contribute based on current IRS limits.

- Access a wide range of assets like stocks, bonds, treasuries, crypto in one portfolio.

- Program recurring contributions that might help align with your goals.

- Automatically pause contributions once you reach the annual IRS limit.

- Trade options within the IRA, if eligible.

- Program trades to align with your investing approach.

- View IRA activity within the same platform where you manage other investment types.

These features might help you manage your retirement savings more efficiently if you prefer a consolidated view of your accounts. Get started with Public IRA!

Frequently asked questions

When can you open a Roth IRA?

You can open a Roth IRA anytime during the year as long as you have earned income. Most people open one through a brokerage or financial app that offers retirement accounts. The deadline to contribute for a tax year is typically Tax Day of the following year.

Can you transfer a 401(k) to a Roth IRA?

Yes, you can transfer (roll over) a 401(k) to a Roth IRA. This process is called a Roth conversion. If your 401(k) is traditional (pre-tax), you’ll owe income taxes on the amount you convert in the year of the rollover. If you’re rolling over a Roth 401(k), only the employer match portion may be taxable.

How many Roth IRAs can I have?

You can have multiple Roth IRA accounts, but your total annual contributions across all of them can’t exceed the IRS limit ($7,000 or $8,000 if 50 or older in 2025).

Can I open a Roth IRA for my child?

Yes, you can open a Roth IRA for your child if they have earned income (e.g., babysitting, part-time jobs). The account must be a custodial Roth IRA, managed by an adult until the child reaches the age of majority (18–21, depending on the state).

Can I have a Roth IRA and a 401 (k)?

Yes, you can have both a Roth IRA and a 401(k) at the same time, as long as you meet the eligibility and income requirements for each. Each account has its own annual contribution limit, and contributions to one do not affect the limit for the other.

Is a Roth IRA the same as a 401(k)?

No. A Roth IRA is an individual account that you open on your own, while a 401(k) is a workplace-sponsored retirement plan. Each has different rules for contributions, taxes, and withdrawals.